Farming Can Qualify for QBI? Know How to Secure Benefits

Did you know that your hard-earned farming income could be eligible for significant tax benefits? Yes, you heard it right! Many farmers unknowingly leave money on the table by not taking advantage of the qualified business income (QBI) deduction. But how can you maximize these benefits? Let’s dive in and explore the fascinating world of farm tax deductions and uncover the secrets to securing your rightful tax benefits.

What is Qualified Business Income (QBI)?

The qualified business income (QBI) deduction is a tax benefit designed to help small business owners reduce their taxable income. If you've been wondering, "Does farming qualify for QBI?" the answer is a resounding yes. Farming operations, like many other businesses, can qualify for this deduction, potentially leading to substantial savings on your tax bills.

Imagine QBI as a lighthouse guiding ships through treacherous waters. Similarly, the QBI deduction helps farming income navigate the complexities of tax law, ensuring you keep more of your earnings from farming. It’s a tax benefit that can make a world of difference in your financial planning.

Understanding the 20% Deduction

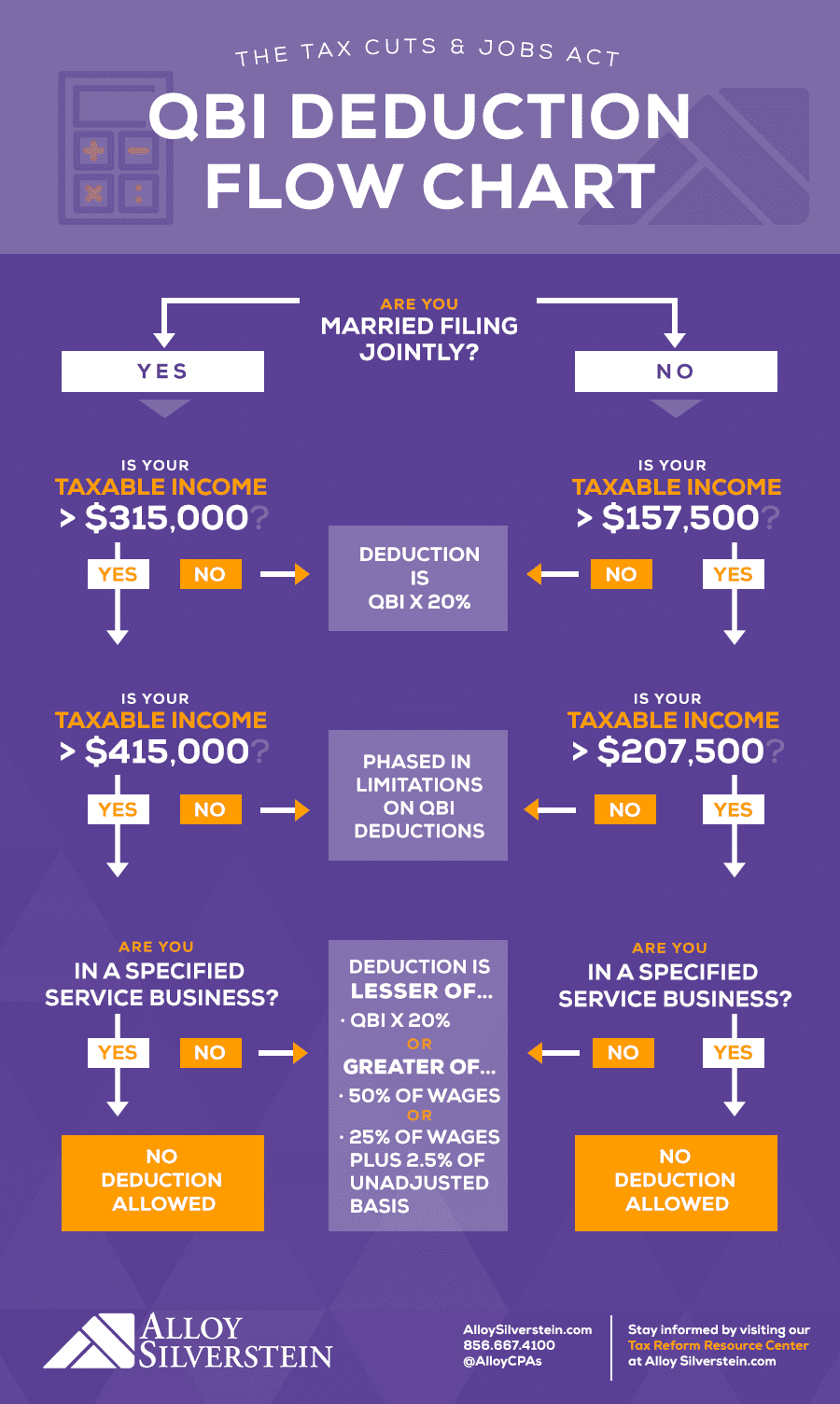

The 20% QBI deduction allows you to deduct up to 20% of your qualified business income from your federal taxable income. This means that if you report $100,000 in farming income, you could potentially deduct $20,000, reducing your tax liability.

However, to qualify, your earnings from farming must meet specific criteria. For instance, the business must be operating in the U.S., not be a specified service trade or business (SSTB), and meet other eligibility requirements. So, how do you ensure your farming operation ticks all the right boxes?

How to Qualify for QBI Deduction

To qualify for QBI deductions, you need to ensure your farming operation meets certain IRS guidelines. Here are some key points to consider:

- Business Structure: Ensure your farming operation is structured as a sole proprietorship, partnership, S corporation, or LLC. While C corporations do not qualify, you can still benefit from other tax strategies.

- Revenue Thresholds: For tax years after 2017, the eligibility phases out based on your taxable income. For example, for married filing jointly, the threshold is $315,000.

- Operational Requirements: Your farming business must be actively engaged in agricultural activities and meet the operational requirements set by the IRS. What this means is you need to be actively involved in the day-to-day operations of your farm.

Do you think your farming operation qualifies? Take the time to review your structure and income to ensure you are eligible. If you’re unsure, consider consulting with a tax professional who can guide you through the specifics.

Maximizing Your Farm Tax Deductions

Once you’ve determined that your farming operation qualifies for the QBI deduction, it’s time to optimize your tax strategies. Here are some tips to help you maximize your benefits:

Operational Deductions

Operational deductions are expenses directly related to the day-to-day operations of your farm. These can include everything from seed and fertilizer costs to equipment repairs and employee wages. By keeping meticulous records, you can ensure you claim all eligible deductions.

Think of your farm as a vast garden. Just as a gardener tends to each plant, making sure it gets the right nutrients and care, you need to nurture your farm’s financial health. Ensure every dollar spent is documented and justified as a necessary business expense.

Investment and Depreciation Deductions

Investments in farming equipment, land acquisitions, and improvements can also provide significant tax benefits. By taking advantage of depreciation deductions, you can spread the cost of these investments over several years, reducing your taxable income each year.

Consider the analogy of planting trees. While it might take years for a tree to grow and yield fruit, the effort and investment in planting it are worth it in the long run. Similarly, investing in your farming operation today can yield substantial tax benefits tomorrow.

Reporting and Record-Keeping

Accurate reporting and record-keeping are crucial for maximizing your farm tax deductions. Keep detailed records of all income and expenses related to your farming activities. This not only helps you claim all eligible deductions but also protects you in case of an IRS audit.

Imagine reporting your farming earnings like completing a puzzle. Each piece of documentation, whether it’s a receipt or a bank statement, is essential in creating a complete and accurate picture of your financial activities. Miss one piece, and the whole puzzle falls apart.

Stay Informed with Up-to-Date Resources

Tax laws and regulations are constantly evolving. To ensure you stay compliant and optimize your tax benefits, it’s essential to keep yourself informed with up-to-date resources. The IRS website, for instance, provides valuable information and updates on tax benefits related to QBI and farming income. Additionally, consult with a tax professional who specializes in farm tax deductions to get tailored advice.

Your financial health is as important as your physical health. Just as you wouldn’t ignore a health checkup, don’t neglect your financial well-being. Stay informed and proactive.

Seize the Opportunity Today

Now that you understand how farming can qualify for QBI, it’s time to take action. Review your farming operation, ensure you meet the eligibility criteria, and start documenting your expenses. Every dollar saved on taxes is a dollar that can be reinvested into your farm or saved for the future.

Remember, the QBI deduction is not just a tax benefit; it’s an opportunity. An opportunity to reduce your taxable income, keep more of your hard-earned farming income, and ensure your financial future is bright. Less talk, more action. Click here to explore more resources and take the first step towards securing your tax benefits today.

Conclusion

In conclusion, the question "Does farming qualify for QBI?" has a definitive answer: yes, it does. By understanding the criteria and taking proactive steps, you can secure significant tax benefits. From operational deductions to investment strategies, there are numerous ways to maximize your farm tax deductions.

So, don't wait any longer. Start your journey towards financial empowerment today. Click to discover more about QBI and how it can benefit your farming income.

FAQs

1. What type of farming operations qualify for the QBI deduction?

Most farming operations qualify for the QBI deduction as long as they meet the operational requirements set by the IRS. This includes operations structured as sole proprietorships, partnerships, S corporations, and LLCs. However, C corporations are excluded from this benefit.

2. How is the 20% QBI deduction calculated?

The 20% QBI deduction is calculated based on your qualified business income. For farming operations, this means up to 20% of your net farm income can be deducted from your federal taxable income. However, this deduction phases out for higher-income taxpayers.

3. What are some common farm tax deductions?

Common farm tax deductions include operational expenses such as seed and fertilizer costs, equipment repairs, and employee wages. Additionally, investments in farming equipment, land, and improvements can provide significant tax benefits through depreciation deductions. Learn more about these deductions on the IRS website.

4. Can I still benefit from the QBI deduction if my taxable income exceeds the threshold?

If your taxable income exceeds the threshold for QBI deductions, you may still be able to benefit from other tax strategies. Consulting with a tax professional can help you identify alternative ways to reduce your taxable income and maximize your benefits.

5. How can I ensure compliance with IRS regulations regarding farming income?

To ensure compliance with IRS regulations regarding farming income, keep meticulous records of all your income and expenses. Regularly review IRS guidelines and consider consulting with a tax professional to stay informed and avoid potential audits.

```

0 Response to "Farming Can Qualify for QBI? Know How to Secure Benefits"

Post a Comment