Discover Expert Tips for Agriculture Financing

Imagine your farm as a fertile field ready for planting. Just as the right seeds and nutrients are crucial for a bountiful harvest, selecting the right agriculture financing options is vital for your farm's success. Whether you're a seasoned farmer looking to expand or a newcomer seeking to start your first agricultural venture, understanding the intricacies of farm investment can be the difference between thriving and merely surviving. So, let's dive into the world of agricultural financing options and uncover the secrets to securing the funds you need.

The Essentials of Agriculture Financing

Understanding Farm Loans

Farm loans are the backbone of agricultural financing. They provide the capital necessary for purchasing land, equipment, and livestock, as well as covering operating expenses. Think of a farm loan as the lifeline that keeps your agricultural dreams afloat. But with so many farm loans available, how do you choose the right one?

First, consider your specific needs. Are you looking to purchase new equipment, expand your land, or manage day-to-day operations? Different loans cater to different needs. For instance, the USDA Farm Service Agency offers a variety of loans tailored to different agricultural sectors. Explore their Farm Loan Programs to see which might be the best fit for your farm investment.

Agricultural Grants: Free Money for Farmers?

Now, you might be wondering, what about grants? Unlike loans, agricultural grants don’t need to be repaid, making them an attractive option for rural development. But securing a grant is no easy feat. It requires meticulous planning, a compelling proposal, and a bit of luck. Think of it as winning the lottery—except you control your odds by submitting a strong application.

Start by identifying relevant grants. The National Institute of Food and Agriculture (NIFA) offers numerous grant opportunities that support agricultural research and innovation. Check out their Grant Programs to see if any align with your farm's goals.

Maximizing Your Financial Strategy

Avoiding Common Pitfalls in Agriculture Financing

Securing agricultural financing is just the first step. Managing your finances wisely is equally important. Many farmers fall into common traps, such as over-leveraging or failing to plan for fluctuations in market prices. To avoid these pitfalls, think of your finances like a garden. You need to cultivate it, nurture it, and be ready to adapt to changing weather conditions.

One effective strategy is to diversify your income streams. Don’t rely solely on one crop or livestock. Explore value-added products, agritourism, or other complementary ventures. This way, if one area faces a setback, others can compensate. Continuously educate yourself on financial management through resources like the Farmers.gov's Farm Record Keeping guides.

Leveraging Technology in Farm Investment

Technology is revolutionizing agriculture, and it’s also transforming farm investment opportunities. From precision farming tools to online marketplaces, tech innovations can boost your farm's efficiency and profitability. Picture your farm as a high-tech lab where every machine and tool is connected, working seamlessly to maximize yields.

Consider adopting farm management software to track expenses, monitor crop health, and predict market trends. Platforms like Climate FieldView offer comprehensive tools for modern farmers. Investing in technology may seem daunting, but the long-term benefits can far outweigh the initial costs.

Special Considerations for Rural Development

Governmental Support and Initiatives

Governments across the globe are aware of the critical role agriculture plays in rural development. They offer various incentives, subsidies, and support programs to encourage farmers to invest in their land and operations. So, why not take advantage of these opportunities?

Start by exploring the USDA Rural Development programs. They provide a wide range of financial assistance options, including grants and loans, aimed at fostering growth in rural communities. Visit the USDA Rural Development website for more information on how you can benefit.

Partnering with Local Communities

Building strong ties within your local community can open doors to unique agricultural financing opportunities. Think of your community as a support system, ready to lend a helping hand when needed. Engage with local agricultural cooperatives, farmer’s markets, and community development organizations.

Collaborating with these groups can provide access to shared resources, reduced operational costs, and valuable networks. By fostering these relationships, you'll not only secure financial benefits but also contribute to the overall development and prosperity of your community.

Conclusion

Embarking on the journey of agriculture financing might seem daunting, but with the right knowledge and strategies, you can turn your farm into a thriving enterprise. From understanding farm loans and grants to leveraging technology and community support, there are numerous paths to financial success in agriculture.

Remember, every farm is unique, and so are its financing needs. Take the time to assess your situation, explore your options, and make informed decisions. The world of agriculture is ever-changing, but with the right tools and mindset, you can navigate it successfully.

So, are you ready to sow the seeds of your farm's future? Discover more about agricultural financing options at Farmers.gov. Click through to start your journey towards a prosperous agricultural venture today!

FAQs

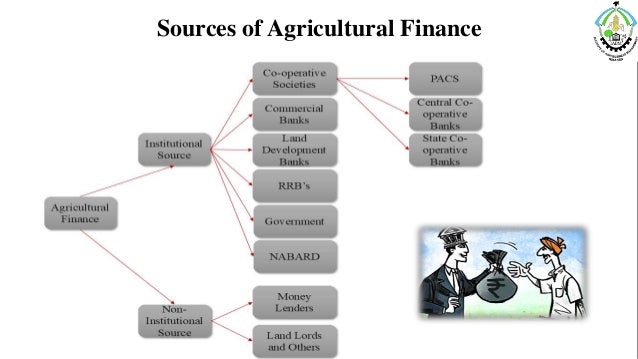

1. What are the primary sources of agriculture financing?

Agriculture financing primarily comes from farm loans, agricultural grants, and cooperative support. Government programs, banks, and private lenders are key sources of farm loans, while grants can be sourced from federal, state, and private organizations. Exploring these options can provide the necessary capital for various farm investments.

2. How do I qualify for agricultural grants?

Qualifying for agricultural grants requires a thorough application process. You typically need to submit a detailed proposal outlining your project, its benefits, and how it aligns with the grantor's objectives. Factors such as your financial stability, experience, and project feasibility also play a role in the selection process.

3. What benefits do farm loans offer?

Farm loans offer several benefits, including flexible repayment terms, lower interest rates compared to conventional loans, and downstream financing options. These loans can fund various aspects of your farm, from equipment and land purchases to operational costs.

4. How can technology improve my farm investment?

Technology can significantly enhance your farm investment by increasing efficiency, reducing costs, and improving yields. Tools like precision farming equipment, farm management software, and online marketplaces can streamline operations and open new revenue streams.

5. Why is community support important in rural development?

Community support is vital in rural development as it fosters collaboration, shared resources, and mutual growth. Engaging with local organizations and cooperatives can provide financial benefits and create a supportive network essential for long-term success in agriculture.

```

0 Response to " Discover Expert Tips for Agriculture Financing"

Post a Comment